The Dark Side of Warning Trading

In the ever-expanding world of online finance, where safety is paramount, the emergence of fraudulent entities like Warning Trading poses significant risks. Claiming to be a beacon of scam prevention and recovery, Warning Trading is, in reality, a nefarious operation designed to exploit the vulnerable. This article delves into the deceptive practices of Warning Trading, revealing its true nature and the dangers it presents.

Fake Regulation: A Facade of Trust

Warning Trading purports to offer regulatory oversight, a critical factor in choosing a reliable broker or financial service. However, this claim is a blatant lie. The organization has no legitimate authority to regulate companies, yet it deceives users into believing otherwise. By distributing sham regulatory approvals, Warning Trading provides a false sense of security, which can lead unsuspecting individuals to trust fraudulent brokers and lose significant sums of money.

Scam Recovery: Preying on the Vulnerable

One of the most insidious aspects of Warning Trading is its scam recovery service. This service preys on individuals who have already been victimized by online scams, offering false hope and further exploiting their desperation. Instead of recovering lost funds, Warning Trading’s scam recovery service extracts even more money from scam victims, prolonging their financial and emotional distress.

For those misled by platforms like Warning Trading, seeking professional legal help is crucial. A reputable law firm, such as Broker Justice, can offer genuine assistance in recovering lost funds and navigating the complex landscape of financial fraud.

Investigations: Incompetence and Malice

The so-called investigations conducted by Warning Trading are another layer of deceit. These investigations are neither thorough nor conducted by cybersecurity experts. Instead, they are filled with incoherent articles and baseless accusations aimed at diverting attention from legitimate services to their scam partners. The individuals behind these investigations lack any relevant qualifications, further proving that Warning Trading’s primary goal is to manipulate and mislead.

Financial Fraud: A Deep Dive into Deceit

Financial fraud has evolved with technology, and entities like Warning Trading are prime examples of modern-day scams. They leverage sophisticated techniques to appear credible while systematically defrauding their clients. This section will explore the various methods employed by Warning Trading to deceive and defraud investors, highlighting their involvement in financial fraud, brokerage fraud, and cryptocurrency scams.

For a comprehensive overview of financial fraud and how to safeguard your investments, consider reaching out to Broker Justice, a law firm dedicated to helping victims of financial scams.

Warning Signs: How to Spot a Scam

Being able to identify the warning signs of a scam can save you from falling victim. Warning Trading exhibits several red flags typical of fraudulent entities, including a lack of transparency, unverifiable regulatory claims, and overly aggressive marketing tactics. Here’s a detailed look at these warning signs.

For a detailed guide on spotting scams, visit Broker Justice’s scam awareness section.

Final Thoughts: Avoiding the Trap

Warning Trading represents the epitome of online deceit, masquerading as a protective service while enabling scams. It is crucial for individuals to be vigilant and skeptical of such entities. Trusting Warning Trading can lead to significant financial loss and emotional turmoil. By exposing their fraudulent practices, we aim to protect potential victims and ensure a safer online financial environment.

In conclusion, Warning Trading is not the ally it claims to be. Its fraudulent activities, from fake regulatory approvals to scam recovery and misleading investigations, highlight the importance of due diligence in the online financial space. Stay informed, stay skeptical, and protect yourself from entities like Warning Trading that thrive on deception.

For more comprehensive information on financial fraud and how to safeguard your investments, visit Broker Justice.

Related Articles:

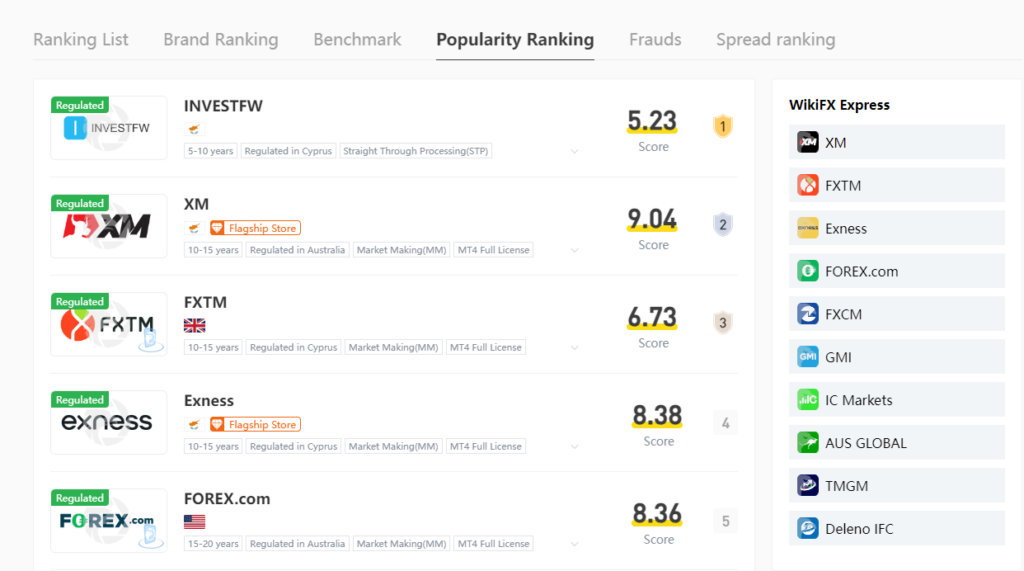

- The Dark Underbelly of WikiFX: A Deceptive Finance Platform

- ScamAdviser: A Scam Recovery Service or Just Another Scam?

No comment yet, add your voice below!