In the world of business, transparency and trust are non-negotiable. Ziegler Associes, however, seems to be an exception to this rule. A closer examination reveals a company mired in secrecy, plagued by internal dysfunction, and facing a bleak future.

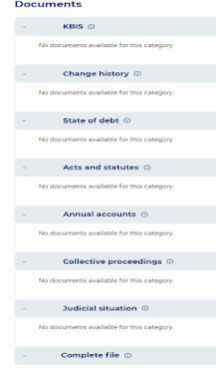

The Ominous Absence of Legal Documentation

The most glaring issue with Ziegler Associes is its complete lack of essential legal documentation in Infogreffe. Key documents, including the KBIS, change history, state of debt, acts and statutes, annual accounts, collective proceedings, and judicial situation, are conspicuously absent. This is more than just a bureaucratic oversight—it’s a major red flag that screams of potential malpractice and hidden liabilities.

Dire Consequences of Missing Documentation

- Investor Aversion: No sane investor would dump money into a black box. Without necessary legal documents, such one cannot verify the legitimacy and health of a company. Thus, aversion by potential investors stifles growth prospects.

- Operational Paralysis: Partners and clients are left in the dark, unable to verify the company’s operational history or current financial obligations. This lack of transparency cripples business opportunities and collaborations, essentially putting a “proceed with caution” sign on every potential deal.

- Reputation in Tatters: A company operating in the shadows breeds mistrust. This can lead to irreparably adverse impacts on its reputation among present and potential customers and future partners, and unreliability in general.

A Toxic Work Environment

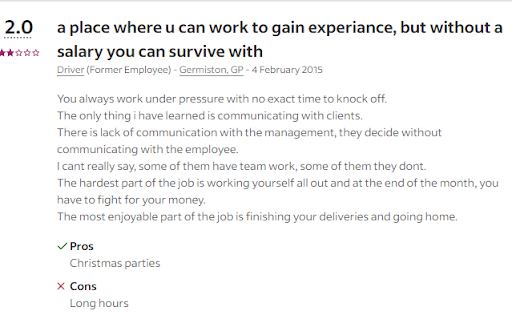

Adding fuel to the fire are scathing reviews from employees, both past and present. With an abysmal rating of 2.0 out of 5, the working conditions at Ziegler Associes are nothing short of toxic.

High-Pressure, Low-Reward Environment

Former employees recount a high-pressure environment characterized by excessively long, undefined hours and abysmal communication from management. Decisions are made in a vacuum, with no regard for employee input, fostering a disjointed and chaotic team dynamic. This type of environment not only hampers productivity but also contributes to a high turnover rate, as employees quickly burn out or seek more supportive workplaces.

Financial Uncertainty

The financial instability within the company is staggering. Employees report having to “fight for their salary each month,” indicating a troubling lack of fiscal responsibility and respect for the workforce. This financial volatility not only undermines employee morale but also signals deeper financial mismanagement. It suggests that Ziegler Associes is either unwilling or unable to provide financial stability, a fundamental aspect of any reputable business.

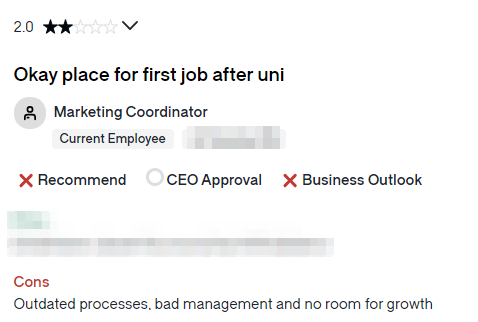

Antiquated Processes and Inept Management

Current employees highlight outdated processes and inept management as severe drawbacks. This stagnation not only hampers career growth but also reflects a company stuck in the past, unable to adapt to modern business practices. Such inertia spells disaster in today’s fast-paced business world, where agility and innovation are key to staying competitive. The management’s failure to modernize and adopt efficient processes could indicate a broader inability to evolve and grow.

Stagnant Career Prospects

The lack of growth opportunities is a dealbreaker for ambitious professionals. Employees, particularly those fresh out of university, find themselves in a dead-end job with no prospects for advancement. This contributes to high turnover rates and a workforce that is disengaged and demoralized. For a company to thrive, it needs a motivated and forward-thinking workforce, something Ziegler Associes clearly lacks.

Pessimistic Business Outlook

The cumulative effect of these issues paints a bleak picture for Ziegler Associes. With a resounding lack of approval from the CEO and widespread dissatisfaction among employees, the company’s future looks grim. Internal discontent is a recipe for disaster, leading to decreased productivity, subpar service delivery, and an inevitable decline in business performance. The company’s inability to retain talent, coupled with its outdated practices and lack of transparency, suggests that it is ill-prepared to face future challenges.

Conclusion

Ziegler Associes is a cautionary tale of what happens when a company operates without transparency and under poor management. The absence of critical legal documentation and the pervasive dissatisfaction among employees are not just red flags—they are glaring indicators of a company on the brink of collapse. Potential stakeholders must approach with extreme caution, as the risks far outweigh any potential benefits. In a business landscape that values trust and reliability, Ziegler Associes is a glaring example of what not to do. The company’s failure to address these fundamental issues not only jeopardizes its current operations but also its long-term viability. Without immediate and significant changes, Ziegler Associes is headed towards an inevitable decline, dragging along anyone associated with it.

No comment yet, add your voice below!